Financing for e-commerce businesses

Growing your e-shop is easier with financing that adjusts to the pace of your business. Softloans offers a more flexible alternative to traditional financing methods.

- Quick funding

- No collateral required

- Flexible repayments

What is revenue-based financing for e-commerce businesses?

This financing model is simple and transparent: repayments are based on a percentage of your revenue. When your income grows, you pay more; when it goes down, your payments decrease accordingly. No fixed instalments, no unexpected surprises – just a flexible solution that adapts to the rhythm of your business!

Benefits of revenue-based financing for e-commerce businesses

Who is eligible for revenue-based financing?

Monthly revenue: at least 3,000 EUR

Your e-commerce business generates at least 3,000 EUR in monthly revenue.

Operating period: active for more than 12 months

Your e-commerce business has been operating for at least 12 months.

E-shop is hosted on reliable third-party platforms

Your e-shop is built using third-party platforms. Currently, Softloans works with Shopify, WooCommerce, PrestaShop, Magento2, Opencart, Wix, and Amazon.

How to get started?

Create an account for your e-shop

Sharing your contact and company details with Softloans is quick and effortless – no lengthy forms, questionnaires, or endless pages.

Select your desired financing amount and the repayment term

Softloans will prepare a financing offer based on the information you provide in the next step, taking your preferences into account.

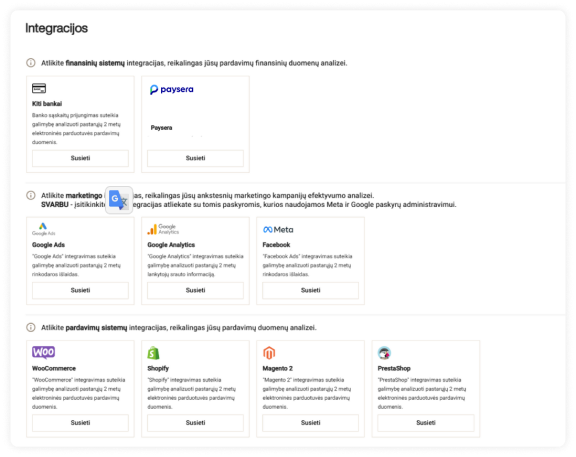

Link your e-shop account with Softloans without any additional documents

Integrating your e-shop platform data, digital marketing, and payment systems will enable Softloans to quickly assess your application and provide the most suitable offer – no additional forms required.

Financing payout

Loan repayment

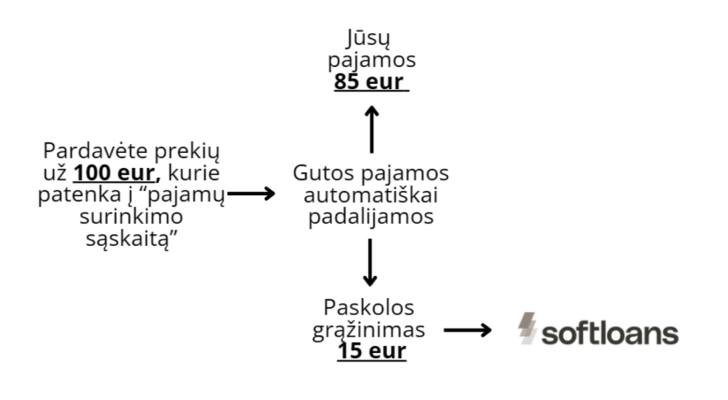

Repayments of your e-shop loan are automatically deducted from the revenue you receive in your Payment account.

For example, if you agree with Softloans to allocate 15% of your revenue for loan repayment.

A gift for you – free analytics of your data

Revenue-based financing can help your business grow, and to make it easier to achieve your goals, the Softloans platform provides valuable insights into your business.

Join the Softloans community today and access free data analytics to gain a deeper understanding of your business opportunities and make informed, data-driven decisions.

FAQ

Financing is available to e-commerce business representatives (legal entities) operating for more than 12 months and generating at least 3,000 EUR in monthly revenue. It is also important that the online store is built using reliable third-party platforms. Currently, the Softloans platform works with Shopify, WooCommerce, PrestaShop, Magento 2, Amazon, Wix, OpenCart, and continues to actively expand its integration options.

You'll only pay a one-time financing fee, starting from 10% of the financing amount.

Here’s an example of a typical financing offer:

Financing amount: 9,000 EUR

Repayment term: Up to 12 months

One-time fee: 10% or 900 EUR

Financing interest: 0%

Early repayment fee: None

Repayment schedule: 15% of revenue

These integrations are essential for Softloans to implement the revenue-based financing model, eliminate the need for collateral, and remove fixed repayment schedules. The data gathered through these integrations allows the platform to accurately assess your business's growth potential and provide the most tailored financing offer.

Softloans only receives aggregated data through these integrations. For example, when you integrate Google and Meta, Softloans won’t have access to specific campaign data – only aggregated, periodic data is shared, which helps forecast potential future e-commerce revenue and tailor the optimal financing offer.

Clear loan fee with no interest. Before receiving financing, the borrower knows the exact fee of the loan – it remains fixed and is paid as a one-time fee.

No collateral required. Business performance data is enough to verify solvency, and the revenue-based financing model provides all the necessary guarantees.

No fixed repayment schedule. Repayments adjust according to the business's profitability. Payments are made automatically by allocating a set percentage of revenue toward loan repayment.

Softloans is a fintech company based in Lithuania, creating innovative solutions that enable SMEs to effortlessly and quickly secure the working capital they need for growth.

Softloans is responsible for the information and the provision of revenue-based financing services.